How to choose a company in the stock market?

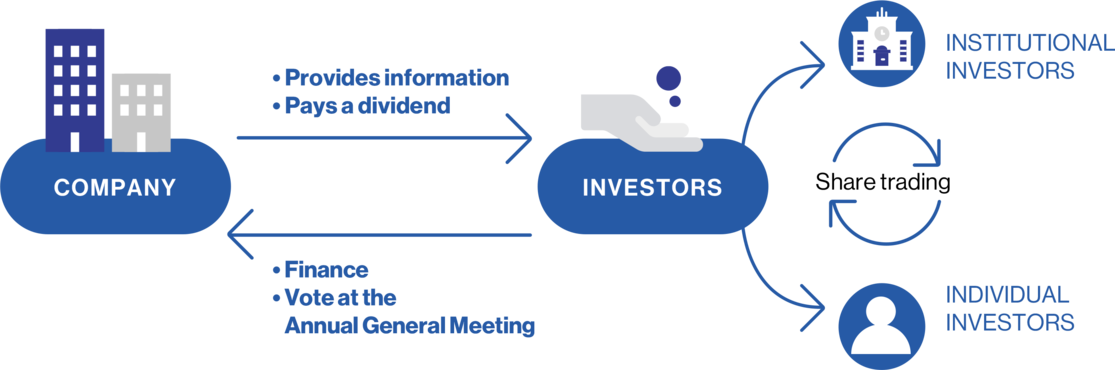

How does investing pays off?

Stock Market :Today, everyone is interested in the Stockmarket and is willing to invest. Adequate knowledge and information is required before investing in the capital market. Before investing in stocks, every investor needs to develop three important qualities in themselves: studious, patient, tolerant. These three things need to be in every disciplined and successful investor.

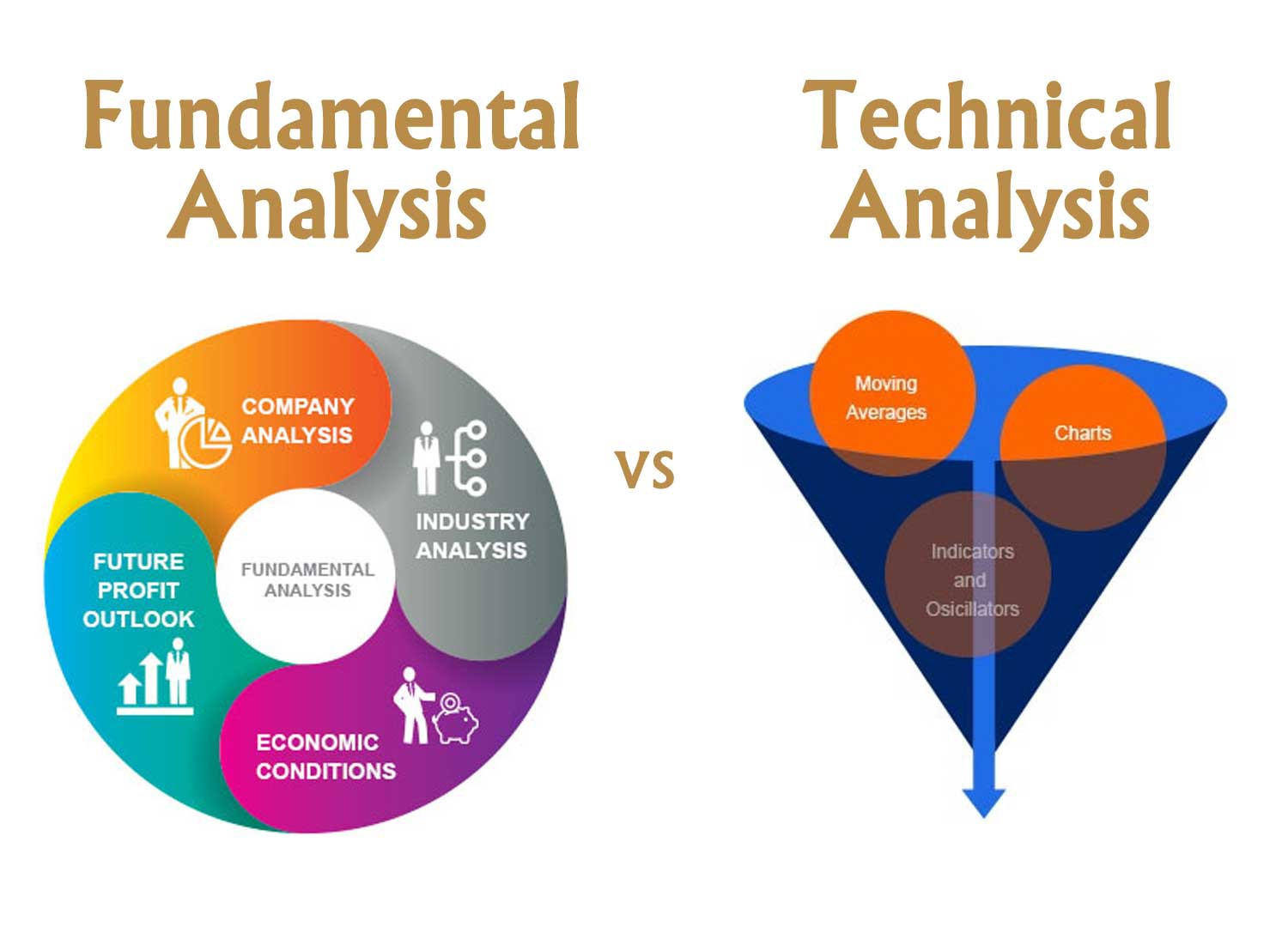

Before investing in the stock market, it is necessary to look at the overall economic condition of the country, industry and business policies, etc. in advance. The country’s economy, business practices, government policies, etc. can affect the return on investment.Investors need to be aware of the government’s plans and strategies for economic growth and the impact it will have on the company’s industry.Risk, return and analysis are the three major elements of the stock market that every investor should understand before making a decision.

Stock Market -Notes Nepal

Factors such as economic activity of the country, balance of payments, inflation, job creation etc. fall under economic policy.There is a positive relationship between the economy and the stock market. If the economy becomes stronger and stronger, the stock market will prosper, and if the economy becomes weaker and weaker, the opposite will happen.

That is why the stock market has increased due to political stability, economic revolution and job creation in the country.Peter Lynch, a world-renowned stock analyst, wrote in his book One Up on Wall Street: “Before investing, investors need to be clear about what the business is, how it can make a profit, and what factors can cause a loss.” For example, before investing in insurance companies, one should be clear about what insurance is, how insurance companies earn, how they can expand their services, and so on.

Benjamin Graham, a value investing guru, says: Understand business first and move forward with investing. Investing without understanding business is speculation.

Therefore, as investors, as Lynch and Graham said, we need to understand the industry first. We should make our investment decision only after understanding the business of the company we prefer to invest in.

Investors should be aware of how the company can beat the market by examining the basic aspects of the company and understanding the business, whether the company has competitiveness among all the industries within its industry (sector) or not. In this way, investors can understand the economy and industrial strategy and decide the strategy to choose a company in the stock market.

Stock Market

Today, everyone is interested in the Stock market and is willing to invest. Adequate knowledge and information is required before investing in the capital market. Before investing in stock market, every investor needs to develop three important qualities in themselves: studious, patient, tolerant. These three things need to be in every disciplined and successful investor.

Before investing in the stock market, it is necessary to look at the overall economic condition of the country, industry and business policies, etc. in advance. The country’s economy, business practices, government policies, etc. can affect the return on investment.Investors need to be aware of the government’s plans and strategies for economic growth and the impact it will have on the company’s industry.Risk, return and analysis are the three major elements of the stock market that every investor should understand before making a decision.

Investors should focus on the following bases to choose a company in the stock market:

1. First of all, be clear about your plan. Be clear about why I’m investing in the stock market, whether it’s building a property, raising a home, educating my children, or insuring.

2. Include undervalued shares in your list.

3. As soon as you understand the business and industry of the company, invest in companies that have earned a reputation in the same industry and have less competition in the business or have more competitive potential.

4. The most important aspect in the company selection process is financial analysis. If all external factors are good, then financial indicators are not good. Before investing in any company, do a good research on the financial condition, health, profit, loss, liquidity, etc. of the company. Set the following minimum bases for evaluating stock market financial indicators:

A.Companies with higher or comparatively higher earnings per share,

B. Companies with low price-to-earnings ratio,

C. Companies with rising profit margins,

D.Companies that regularly distribute bonuses and dividends,

E. A company focusing on service and product delivery,

F. It is equally important to evaluate the stock market financial statements as well as the non-financial aspects of the company. Such as efficient management of the company, institutional good governance, management strategy towards moving the company forward, programs, holding general meetings on time, etc.

5. Be aware of regular market activities and be studious at the same time. Get in the habit of searching for information and financial information published by the share market company.

6. Set a time to enter and exit the stock market.

By investing wisely on the above mentioned bases, the risk in your investment can be minimized.

Comment Here!